For many people, there’s much more to choosing investments than focusing exclusively on financial returns. Returns are important, but a growing number of people also want their investments align with their values.

Everyone’s values are different but given the choice most people would wish to make a positive difference to their community and/or the planet. Or at least to do no harm.

Indeed, many Australians believe environmental issues are important when it comes to their investment decisions.

As a result, there has been a surge in what is called responsible investing. Also known as ethical, sustainable, or positive impact investing, responsible investing includes investments that support and benefit the environment and society, rather than those whose products or way of conducting business have a negative impact on the world.

Millennials Driving Growth In Sustainability

The trend toward responsible investment is growing rapidly. According to the Responsible Investment Association of Australasia (RIAA), Australians invested $1.2 trillion in responsible assets in 2020. While money flowing into Australian sustainable investment funds was up an estimated 66 per cent in the year to June 2021.

Responsible investing is particularly popular among millennials, now in their late 20s and 30s and beginning to get serious about building wealth. Many in this group are getting a foot on the investment ladder via exchange-traded funds (ETFs). A recent survey of the Australian ETF market found 28 per cent of younger investors had requested more ethical investments.

More Sustainable Investment Options

As awareness of responsible investing grows, so does the availability of sustainable investment options, beginning with your super fund.

Most large super funds these days offer a sustainable option on their investment menu. While relatively rare even 10 years ago, the availability and performance of sustainable options has grown strongly over the past three to five years.

According to independent research group, SuperRatings, the top performing sustainable options now surpass their typical balanced style counterparts in some cases.

If you run your own self-managed super fund (SMSF) or wish to invest outside super, there is a growing number of managed funds that actively select sustainable investments, or ETFs that passively track an index or sector.

There were 135 sustainable funds in Australia and New Zealand in 2021, so there is plenty of choice.

How To Screen

So how do you find the ethical investments that best suit your values? Well we wouldn’t be doing our job if we didn’t say engage with your financial adviser.

There are several methods used with the most common being negative screening. This is where you exclude investments in companies engaged in unwelcomed activities such as gambling, tobacco, firearms, animal cruelty, human rights abuses or fossil fuels.

Positive screening is the opposite, where you actively seek out investments in companies making a positive contribution. Some examples might be companies involved in renewable energy, health care or education.

Another criterion is to look at companies that monitor their environmental, social and governance risks. This cuts across all industries and is more about the way the company conducts its business.

Environmentally they may monitor their carbon emissions or pursue clean technology, socially they may be active in ensuring a safe workplace and on the governance front they may pursue board diversity or anti-corruption policies.

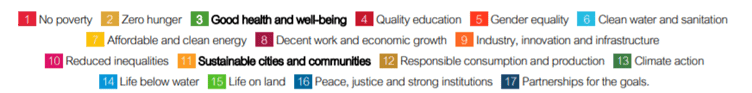

At Moneyclip, we use a filter based on our client’s preferences to determine from the list below which are the most appropriate options when selecting and establishing their tailored portfolio.

Greenwashing On The Rise

As the popularity of responsible investing grows, so do concerns about the practice of so-called greenwashing. This is where a company or fund overrepresents the extent to which its practices live up to their promises. The Australian Securities and Investments Commission (ASIC) recently announced a review into the use of greenwashing in Australia, prompted in part by the demand for such funds.

Another trend is impact investing in companies or organisations helping to finance solutions to some of society’s biggest challenges. This might include investments in areas such as affordable housing or sustainable agriculture.

Solid Returns

While some investors are driven by their values alone, many more want value for their money. The good news is that it’s possible to have it both ways. Although there will be occasions that you will need to forgo some return in order to maintain the responsible investing mandate.

Moneyclip has a responsible/ESG investment solution that is used when working with our clients to set up their bespoke portfolio which is aligned with their investing preferences.

If you would like to discuss your investment options and how they might fit within your overall portfolio, please email us at myadviser@moneyclip.com.au or give us a call on 02 9299 2292.